"Shepherd won the business for two reasons, people and value. The team made themselves available to meet with the client, which was very well received as our client is a relationship buyer and they were able to provide tremendous value by offering multiple layer options at competitive rates with solid coverage. The client is ecstatic with the results and is looking forward to a long partnership with Shepherd."

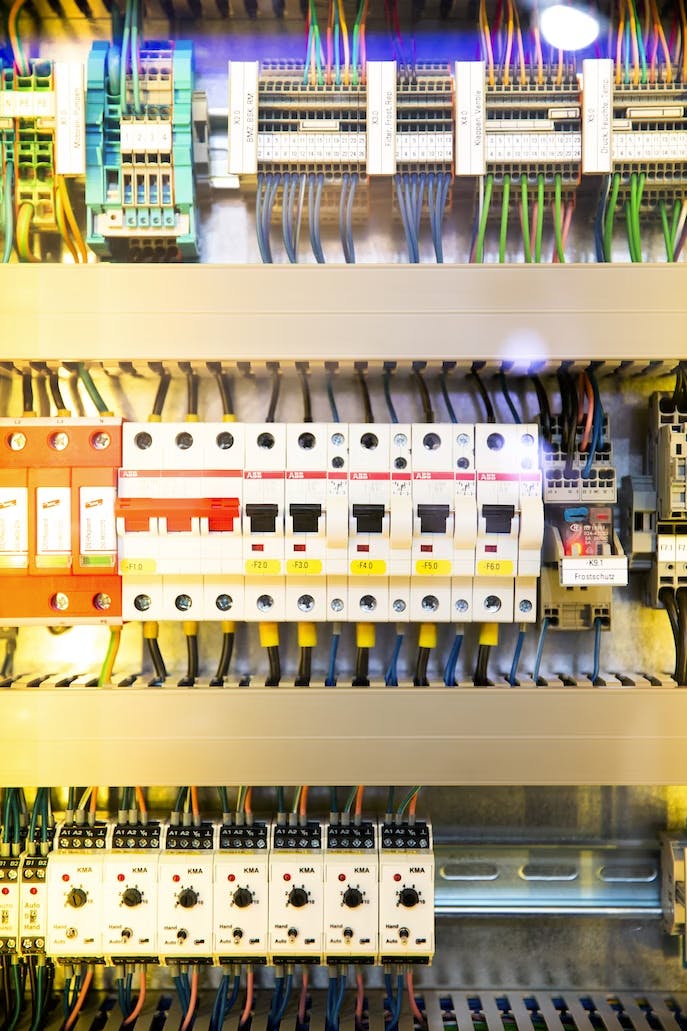

After meeting with the broker to discuss prospective opportunities, the broker sent this submission to Shepherd for a review. We provided our initial indication within 24 hours and immediately activated our Savings offering given the insured's usage of technology partners Procore and OpenSpace. We quoted multiple layers within the tower in order to identify the best option for the client’s program needs.

The initial conversation around Shepherd Savings led to an engaging client meeting between Shepherd, the client's CIO, and the Director of Risk Management. After discussing the program, treatment of construction tech data, and benefits for the insured, our team moved forward with a preferred Savings option. Based on the insured’s strong adoption of Procore, we were able to provide revised pricing and terms for our proposed layer that ultimately secured the win. We formed a strong partnership with the broker through our communication and responsiveness throughout the process.

After a discovery call to introduce a new Shepherd initiative for leveraging AI to assist with automating certificate of insurance (COI) reviews, the insured volunteered to participate in a pilot customer cohort. The insured's existing process to review COIs and was largely spreadsheet driven and required significant time from the risk management team to complete. Requirements for subcontractors were allocated based on the combination of project location and trade type. This added additional complexity (and time) to the review process.

With Shepherd Compliance the insured was able to:

Centralize COI reviews in a single platform

Sync projects and vendors from Procore

Assign dynamic requirements to vendors based on project location or subcontractor trade type

Automate renewal processes

We successfully renewed the client's policy for a second coverage year providing additional premium credits in consideration for usage of Shepherd Compliance. The client continues to benefit from the Savings program which recognizes the use of construction tech on jobsites. We are proud to continue working with this client and their exceptional brokerage team.

Underwriting Profile

$10M Excess

Shepherd Savings Partners

Underwriter

Lindsay Plotkin

Underwriting Lead

More Case Studies

$263M Highway Project in Texas

$5M lead umbrella for 51-month project

$329M Electrical Contractor in Iowa

$5M excess liability policy for contractor practice program

Shepherd’s Combined Casualty & Builder’s Risk Offering for $87M Life Sciences Development Project

Primary GL, Lead Excess, & Builder's Risk

Any appointed broker can send submissions directly to our underwriting team